The World Parity Unit: Frequently Asked Questions

What is WPU?

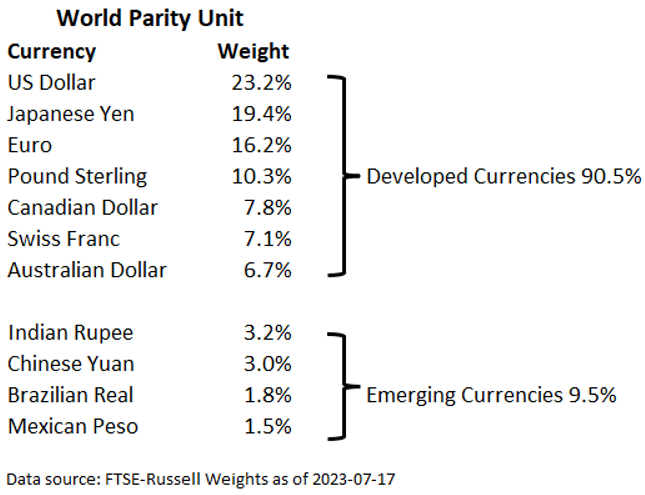

The World Parity Unit (WPU) is a basket of eleven currencies: the seven largest developed market currencies and four emerging market currencies. The eleven currencies in WPU account for 88% of all global currency trading[1]. WPU is a private sector store of value currency basket.

WPU was designed to minimize risk and to preserve investors’ wealth in the long run, and in global terms. Diversified exposure to seven developed currencies minimizes the short run risk of currency devaluation. The 9.5% weight in four emerging currencies helps preserve global purchasing power.

Why does WPU have low risk?

Currencies trade against each other. Hence, if one currency goes down significantly, then another must be going up. Hence, loss in the value of WPU against an individual currency is reduced by diversification.

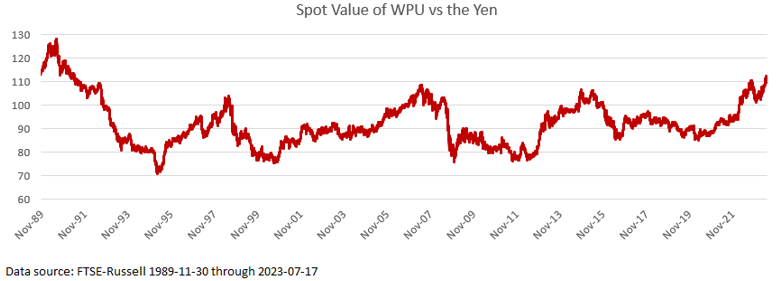

If we examine short run returns of WPU against a volatile currency, there is a small reduction in the daily volatility. But long-term investors are concerned over how much they may lose over the long run. Here is the chart of the spot return of WPU against the Yen over the last twenty years.

Note that there is an additional return for Japanese investors, which comes from the fact that the WPU interest rate is higher than the Yen interest rate. The inherent capital preservation in WPU contrasts with investment in equities and bonds. In a crisis, diversification fails in equity and bond markets because they can all fall together. So, wealth is lost.

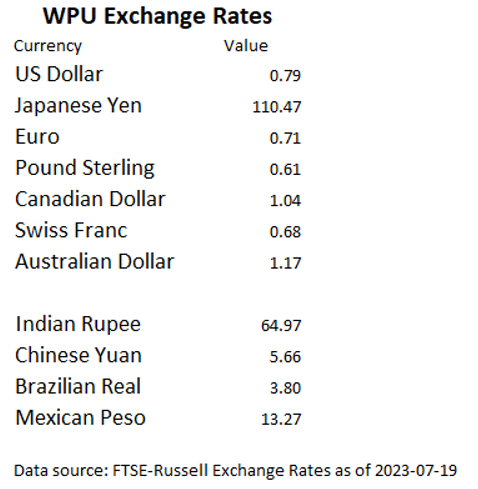

What is the value of one WPU?

The following table gives the rates of WPU against the major currencies as of July 17, 2023:

The WPU settlement rates against the major currencies are published daily by FTSE and disseminated by data vendors.

What is the interest rate on WPU?

The interest rate on WPU is equal to the weighted sum of the interest rates of the eleven component currencies. On July 19th, 2023, the one-month interest rate on WPU was 3.0%.

What has the historic performance of WPU been?

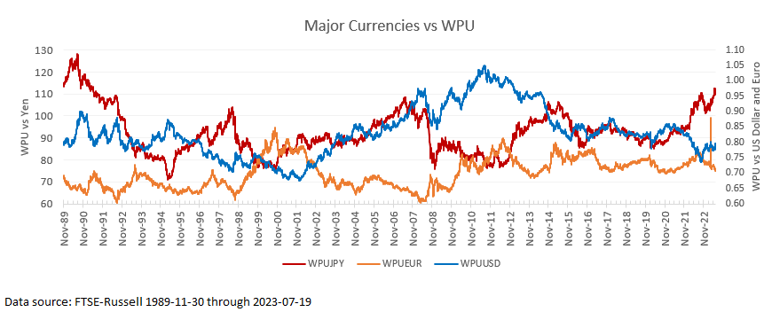

The return on WPU depends on the currency in which the return is measured. The chart below shows the returns from a US Dollar, Euro and the return for a Yen based investor in WPU.

Over this thirty-year period there has been very small net move in the value WPU. Due to the higher interest rate in WPU, WPU has appreciated slightly over this very long-time horizon against these major currencies.

Smaller currencies are more volatile. So smaller currencies will rise and fall more against WPU. This highlights the point that an investor’s local currency is volatile, when measured in global terms.

How can I buy WPU?

WPU is a currency basket. An investor can buy the eleven individual currencies in a portfolio with the WPU weights. WPU can also be provided by financial institutions in the securitized form of a WPU vs USD NDF. So the WPU currency basket can be traded as one unit against the US Dollar.

How can the WPU currency basket be used by institutions to reduce their existing currency risk?

An investor may have investments in one country, or a group of countries. The currency exposure is determined by the attractiveness of the investments, without consideration of the outlook for the currency. This creates a major risk. Typically, the currency risk is close to one half of the total investment risk. This unplanned currency exposure can be reshaped into the lower risk WPU currency basket. Hedging overseas investments into WPU reduces the chance that the local investment returns will be eroded by a currency loss.

Note that when the investments are hedged into the WPU currency basket, the underlying investments are not disturbed. This activity of separately hedging foreign currency risk is called “currency overlay management”.

What is the likely future return of WPU against the US Dollar?

WPU was not designed to be a source of return. WPU was designed, based on sound investment principles, to minimize risk and to preserve wealth in the long run, in global terms.

There is no expected return associated with the developed currencies in WPU. However, there is evidence, based on the Harrod-Balassa-Samuelson effect, that the exposure to emerging market currencies may provide a long-term return. Hence, over the long run, the WPU basket may appreciate against the developed currencies[2].

How can WPU be used?

a. For EM borrowers:

- A highly scalable, non-USD source of capital.

The climate financing need in Asia is $400bn per year. Developing countries already have too much US Dollar debt.

The bonds issued by developing countries are the assets in the portfolios of global institutional investors. WPU indexed bonds were explicitly designed to be a core investment for all global investors, as a complement to their very large existing allocation to US bonds. A WPU indexed government bond has 20% less risk than a US bond and will perform better when the US Dollar falls, or US rates rise. So, the potential size of demand for WPU indexed bonds is very large indeed.

Speaking technically, WPU indexed bonds “Complete markets” (in an Arrow-Debreu sense). By separating the highly concentrated single currency vs US Dollar risk from the provision of capital risk is dramatically reduced both for borrowers and investors. That is why we believe that the launch of WPU indexed bonds will have the same catalytic effect as the first $200m World Bank – IBM currency swap in 1981. Forty plus years on, the currency swap market now trades $127bn per day.

In contrast, although it sounds very attractive, local currency debt issuance runs into a simple arithmetic problem: EM debt is ~2.5% of the fixed interest allocation of global institutions. There are ~150 developing countries. Some 80% of local currency debt is issued by six of the stringer/larger developing countries. The developing countries most in need of global capital have the least access to issuance of debt in their own currency. Local currency bonds are fractured, heterogeneous, instruments with no secondary market, no possibility of hedging the risks and of developing parallel financing markets. - Far lower USD to EM risk.

The big risk for a borrower in a developing country is of a very large rise in the global value of the US Dollar. WPU only has 25% weight in the US Dollar, plus it has 9.1% in emerging market currencies. So, if the dollar jumps up by 10%, a debt which is indexed to WPU will barely go up in global terms. - Lower cash buffer required.

A WPU indexed bond has 20% less volatility than a US dollar bond. So WPU borrowing has lower short run risk than Dollar borrowing. That means the borrower does not have to borrow so many extra US dollars as a cash buffer to protect against a sharp USD rise. - Lower borrowing repayments

Currently, the ten-year WPU government rate 3.26 %, ten-year treasury 4.01% (9/5/23). That is 18% lower repayments.

b. For Global Investors

- Investors are globalizing their portfolios. So, the “basket of consumables” for investors is future global financial assets. Short run returns on global financial assets cannot be forecast consistently. However, the long run return on any investment is dominantly determined by the purchase price at which the asset is acquired. If an asset is acquired at a low price, relative to the earnings which the asset will provide, then the future long-term return will be high. Equally, assets acquired at a high price will provide low long-term returns.

The local currency of an investor can rise, or fall, by very large amounts against the US Dollar in under three years. When the investor’s home currency falls in global value, then foreign assets will be expensive. However, by stabilizing the global value of part of their portfolio, they can buy global assets at favorable prices throughout financial cycles. This is how preserving wealth in global terms provides a significant boost to the investor’s long term expected return.

c. For Investment Managers

- Investment managers can differentiate their strategies, and expand their global client base, by offering share classes on their strategies hedged into WPU. Usually an investment manager in, e.g., the UK will set up separate hedged share classes to sell their fund in the US, Europe, Australia, and Japan. If they hedge their fund into WPU, then that single hedge share class can be sold to an investor in any country globally. The investment is also more attractive, because the single currency volatility has been replaced by the low volatility of the WPU currency basket.

d. For Banks

- Banks can expand their client base by market making in WPU. WPU is a spot reference index. Clients will wish to roll their existing exposures into a long WPU exposure. This helps clients and provides the bank with a stable natural business flow.

e. For UNHW Investors and Family Offices

- The priority of UHNW investors is preserving wealth for the future generations. UHNW investors are truly global citizens. Their wealth should not be measured in just one currency – as a single currency may fall in global value. When the Euro fell against the US Dollar, a private wealth manager should be able to tell clients how much wealth they have lost in global terms.

Historically investment managers measured their clients’ wealth in just one currency: the home currency, US Dollars, or Swiss Francs. For clients outside Europe, most managers measured performance in US Dollars. UHNW clients should know the value of their wealth in global terms.

f. For Sovereign Wealth Funds

- Sovereign wealth funds must establish a neutral currency benchmark in which to invest, and measure, their returns. Historically SWF’s employed either the US Dollar or a mix very heavily weighted to US Dollars and Euros. WPU is a currency basket which is less risky. WPU is also not US or European centric. The use of WPU can boost the development of local financial markets within their home country.

g. For Large Institutional Investors in smaller countries

- Very large investors in countries with less liquid currencies can manage their currency risk with WPU and thus create a higher returning portfolio. Fully hedging the foreign currency risk eliminates diversification. Being unhedged creates exposure to high foreign currency volatility. Hence the only viable solution for very large investors in these countries is hedging into a basket of currencies. WPU is a better alternative to existing ad hoc basket weights.

How is WPU constructed?

How are the weights in WPU determined?

Fiat currencies create two separate risks of loss of wealth. The first risk is the short run risk of currency devaluation. The second risk is the long run erosion of global purchasing power from inflation.

Short run currency devaluation risk is addressed by diversified exposure to the developed currencies to minimize the volatility of WPU in US Dollar terms, subject to diversification and liquidity considerations. The US Dollar is included in WPU at the US share of global GDP.

Long run purchasing power is protected by including the currencies of four large emerging market economies, Brazil, India China, and Mexico, at their share of world GDP[3]. The full methodology for determining the weights is laid out in the published WPU Ground Rules on the FTSE website.

How is the price of WPU calculated?

FTSE calculates a spot reference price for WPU at 4pm time in London. The WPU calculation is based on the latest trading prices for the eleven component currencies.

An investor using WPU will hold e.g., a WPU forward contract, against their local currency, with a one-month maturity. The return on WPU against the investor’s home currency is equal to the spot return plus the interest rate differential between WPU and their local currency.

How often do the weights in WPU change?

The weights are re-calculated each year, with the new weights set on the first business day in December. The weights are updated based on the methodology laid out in the Ground Rules. The annual percentage change in WPU weights is small. Thus, in December 2019, the weights changed by 2%. During the year, the weights of the components within WPU evolve based on the currency returns. Thus, if the Dollar rises vs the other currencies, then the percentage weight of WPU in the US Dollar will rise through the year. This means that an investment in the WPU basket can be held passively[4], there is no need for any trading to keep the portfolio in line with the WPU weights. In force majeure circumstances, an intra year change can occur. One example was the elimination of the Ruble when the trading was suspended. This had very little impact on the return of the index.

Who designed WPU?

WPU was designed by FTSE working with MPG (Mountain Pacific Group, LLC). There was initial discussion on the goals for WPU with the foreign exchange departments of five central banks. Central Banks requested that WPU be independently calculated based on a published methodology, and that as OTC volume develops, trading takes place on a regulated market. Banks, institutional investors, high net worth investors, investment consultants, monetary experts also provided valuable input. Their insights and feedback is gratefully acknowledged.

Why is WPU needed?

What has caused the need for WPU?

The currency market is by far the largest financial market in the world. Daily turnover in the currency market was $7.5 Trillion per day in April 2022. This currency trading volume was 36 times the daily turnover on the New York Stock Exchange. All investors are globalizing their portfolios, so typically over 25% of the investment portfolio is now held in foreign assets. As a result, foreign currency has become the second largest risk for institutional investors after equity risk. Unmanaged currency can have a very good, or very bad, impact on returns. For example, since the Dollar’s peak in July 2011 through August 2023, US investors have lost 37% of the value of the investments in ex US developed market equities.

Based on FTSE-Russell monthly data since 2003, ex US equities have 16.8% volatility. Of this, 6.9% is due to currency volatility. Hence, 41% of the risk of investing in ex US equities is currency risk. Very few funds manage, or even report, the impact of these currency returns. Accepting unmanaged currency exposure, equal in to the size of equity market weights, makes no investment sense. Had the foreign currency exposure been hedged into the WPU basket, the very large currency loss would have been reduced by more than 50%. For the average US fund, the total fund return would have been raised by ~1.3% per annum. That is larger than all the active manager programs combined.

Why does use of WPU stabilize currency flows?

The largest source of foreign exchange transactions is flows from global investors. Ex US investors typically have over 70% of their offshore investments invested US Dollar denominated assets. When their home currency moves against the Dollar, they are forced to act in a pro-trend destabilizing way. This has been seen, for example, in the dramatic fall in the Yen since the start of 2021.

The US has by far the largest global financial markets. That is why ~70% of all new global savings flows have gone into US assets. These flows have driven up the global value of the US Dollar and US asset prices. The currency shifts by global investors creates major currency instability. This heightens the risk of asymmetric currency shock[5]. Adoption of the diversified WPU currency basket will dampen the destabilizing shifts in currency allocation by global investors. That was the key reason for the very positive response of central banks to the introduction of WPU.

What is the benefit of using WPU?

Currency swings have a large impact on an investor’s wealth. Investors spend a lot of time evaluating different opportunities to invest their capital. However, the resulting currency exposure is a very large part of the risk and return of offshore investment.

There is a major difference between a loss caused by equities and a loss caused by a currency fall: Equities represent claims on productive assets. So an investor will eventually recover a loss in equity investment. In contrast, there is no evidence that currency losses come back. Currency moves are random. Hence, after a currency loss, a further currency loss is as likely as a currency gain[6].

The key principle which investors use is to diversify their investments. Diversification reduces loss of wealth during bad times. WPU applies this fundamental diversification principle to the currency exposure which investors already have. The global QE programs have amplified the cumulative currency moves.

Could the US Dollar be replaced by another currency or currency basket?

No. The US Dollar is the world’s leading reserve currency. There are four reasons why the Dollar cannot easily be replaced as the world’s medium of exchange.

- The Triffin paradox

For a currency to become the world reserve currency, the country must run a very large external deficit for many decades. This enables other countries to build up large balances of this currency. The currency is then available in sufficient quantities overseas to be used as a global money. - The network externality effect

The entire global financial system is set up to run on US Dollars. So, 88.3% of all global foreign exchange transactions are against the US Dollar. The network externality effect is not just the fact that the world’s payments system and pricing of goods is in US Dollars. The entire fabric of the global financial ecosystem is based on US Dollars. - Depth and strength of the US Financial System

The US financial system has unmatched characteristics. The capital markets are far larger than any other country. The US financial system is very well regulated and has very strong financial institutions. In addition, it has a very deep financial ecosystem of borrowers, investors, and financial institutions. - The Anglo-Saxon Legal system

The Anglo-Saxon legal system provides a very deep framework to protect the interests of investors and borrowers without discrimination as to their home country. The large body of case law covers many of the possible contingencies in a predictable way

Who should use WPU?

WPU was developed for use by borrowers and by global investors. Historically, investors had major “home country bias”; they invested all their assets in their own country. Today, all investors are globalizing their portfolios. In any form of investment, the investor will wish to have a neutral portfolio against which to measure their performance.

Global investors must have some currency mix. The question of the appropriate currency mix is the first question which Monetary Authorities, Sovereign Wealth Funds and Family Offices must address. Determining the best currency mix is the most fundamental question for investors who are seeking to preserve their wealth in global terms.

Implementing WPU.

How can I invest in WPU?

A fund can hedge its existing currency risk into WPU by using a non-intrusive currency overlay program. Currency overlays have been used for the past twenty-four years by the world’s largest investors to manage their currency risk. Investment managers can also offer their investments hedged into WPU. Large funds with internal trading capability may be able hedge their investments into WPU themselves.

Who makes a market in WPU?

Banks can offer hedges for investors into WPU. Investors can hire managers to undertake this hedging into WPU for them. Institutional investors with internal trading desks may be able to execute the hedge into WPU themselves.

Role of WPU in the portfolio

How do I use WPU?

Investors do not have to alter their underlying investment of capital. A separate transaction converts the concentrated currency risk into WPU. Thus, an institutional investor may, for example, hedge investments in the US Dollar, or Euro, into WPU.

The hedging is carried out using short term, generally one-month, forward contracts. The value of the assets being hedged is obtained from the global custodian. The size of the currency hedges into WPU is adjusted monthly as the value of the overseas assets change. An investment manager can also offer investments which are already hedged into WPU.

What contributes to the return on WPU?

The return on WPU comes from the rise or fall in value of the currency in which the return is measured. Because WPU is a diversified basket of all the major currencies, in the short run it will go up against some currencies, but down against others.

In the long run, we believe that inflation will erode the value of the developed currencies. This is because these countries have engaged in extreme QE. They also have low growth, aging populations, and declining savings. The emerging markets are the largest source of world growth and are the marginal price setters for global goods. The inclusion of EM currencies in WPU aids in preserving the long run global purchasing power of WPU[7].

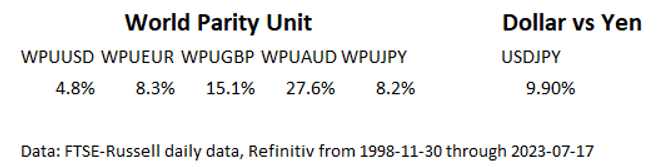

How volatile is WPU?

Measured in terms of US Dollars, WPU has an annualized volatility of 4.8% per annum. When viewed from the base of a smaller and more volatile currency, WPU has higher volatility. This is because the home currency is itself volatile. Here is the table of the volatility of WPU against the major currencies.

Investors in developed countries never used to think of their home currency as being risky. Today, global investors realize that all currencies are risky.

Why is WPU better than what I am currently doing?

Historically, most investors never explicitly considered the currency risk they were taking. Investors believed that the impact of currency swings “wash out over the long run”. They also believed that their home currency was riskless. The problems with the Euro and Yen show that neither is the case.

Investors should explicitly choose the currency risk that they take. An investor in global equities is 62.1% exposed to the US Dollar and 8.3% exposed to the Euro[8]. Taking unequal 70.4% exposure just to two volatile currencies is not optimal. WPU is diversified to minimize concentrated currency risk.

I would like global cash, can I make a deposit in WPU?

Cash can be invested based on the weights in WPU. A global cash fund makes short term investments into the eleven currencies based on the WPU weights.

Investors’ questions

Why should we want any foreign currency exposure at all?

Investors keep a large proportion of their assets invested locally. If there is an extreme event, then both the local market and the local currency can fall. Holding a portion of foreign currency reduces this investment tail risk significantly.

In the long run, the beneficiaries of the assets are exposed to global fluctuations. If emerging market currencies rises against the home currency, then the price of goods from these countries will rise. Today, a large percentage of consumer and other manufactured goods are produced in these emerging economies. So holding a portion of emerging market currencies is prudent. Diversification is the fundamental way for investors to manage risk. WPU diversifies the local currency risk for an investor.

What will happen if the Euro breaks up?

If the Euro is restructured, WPU will be adjusted so that it includes the currencies of the “hard currency” members.

What happens if there is a market disruption event?

If there is a market disruption event, there are established and accepted market standard procedures for determining prices for a range of asset classes. These procedures are laid out by the foreign exchange standing committees. WPU would be calculated based on these principles.

Our fund has local liabilities. Why not fully hedge to eliminate all foreign currency risk?

If a fund fully hedges foreign currency, this creates potentially very major cash flow risk. Most large investors hold near 25% of their assets outside their home country. A currency hedge sells the foreign currencies and buys the home currency. If the home currency falls, there is a paper gain on the value of the foreign asset, but an immediate cash settlement loss on the monthly currency hedges. Historically, these negative cash flows from fully hedging have exceeded 25% of the value of the offshore assets. This forces funds which fully hedged to stop hedging. Unfortunately, this was often at the worst time.

During a crisis, the home currency may plunge in value against the foreign currencies: so, the hedge then has a large loss. This often happens just as all financial markets are falling in value. The currency hedge is a short-term contract that must be settled in cash. During 2008 many large investors, particularly in Australia, experienced extreme cash flow difficulties in settling their currency hedges. They had to sell domestic equities to meet the passive hedging losses.

As a US investor, why do I need the US Dollars in WPU?

The US Dollar has 25% weight in WPU[9]. All currencies are quoted against, and trade against, the US Dollar. Roughly half of the time the US Dollar will rise against the other components of WPU and half of the time it will fall. Including the US Dollar reduces the risk of WPU.

US investors who invest in foreign developed market equities on a capitalization weighted basis have 43% exposure to European currencies. Most investors do not want such a concentrated bet on the future of the European currencies. Hedging into WPU immediately hedges 23% of the risk back to US Dollars and reduces the remaining currency risk by diversification.

How does WPU differ from Cryptocurrencies or Stable Coins?

WPU is not a cryptocurrency! Many competing groups around the world are promoting new cryptocurrencies, stable coins and new payments mechanisms. Few of these groups have experience in the institutional investor currency management needs. New DLT technologies will disrupt many, very different, aspects of the world monetary system. But most of these new DLT technologies address different needs from the currency hedging needs of large institutional investors.

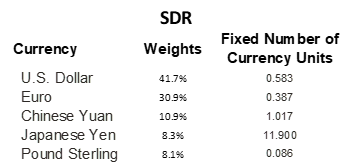

How does WPU differ from the SDR or USDX® currency baskets?

WPU is designed specifically to be a private sector, store of value, currency basket.

In contrast, the SDR is an international agency, unit of account, currency basket. The SDR is a fixed basket of four major currencies. It was designed in 1969 by the IMF to replace Gold as the unit of account for international agency accounting purposes[10]. The SDR was not developed as a store of value for global private investors. The SDR fails four of the ten criteria to be an institutional index.

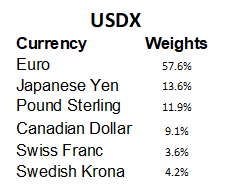

USDX® is a fixed basket of six major currencies[11]. USDX was designed so traders can take active positions on the global value of the US Dollar. Hence, USDX does not contain the US Dollar.

USDX® is a United States specific index based on historic US trade flows[12]. Today, global trade flows only accounts for some 2% of daily foreign exchange transactions.

Why are other emerging market currencies, like the Korean Won, not included?

Smaller currencies are less liquid. During a crisis it is impossible to trade these currencies in any size. The four emerging market currencies have a large percentage share of global GDP. They are liquid due to the size of the currency transactions arising from their trade flows. Trade flows do not stop during a financial crisis. In the future, other emerging market currencies may be included when their economic size and trading liquidity justify inclusion.

Managers say currencies swings wash out in the long run, so why use WPU?

Currency swings do not always wash out in the long run. For example, the Yen was 385 to the US Dollar in December 1971, and reached 77 at the end of 2011. The Yen has not reverted to anywhere near 385 during that period. Currencies are volatile. So, currency moves can exceed the investment return. Most large investors hold over 25% of their assets overseas. Currency returns cannot be forecast consistently. Hence, the risk reduction offered by diversified exposure of WPU is the safest, and lowest cost, way to manage the currency risk.

Should there be a tailored version of WPU for another country?

For a large investor with a very long-time horizon, there could be the case for adjusting the WPU basket based on the country’s unique characteristics. For example, Japan has no commodities and is dependent on imported oil. Hence, there is a case for increasing exposure in a Japanese WPU to currencies, like the Canadian Dollar or Australian Dollar which may appreciate if the oil or commodity prices rise strongly. Equally a country like Norway has very large oil price exposure, and thus should underweight the Australian Dollar, and maybe the US Dollar.

The tailored WPU can be implemented as a combination of the standard WPU plus a set of country specific over and underweights of currencies.

Tailored WPU = WPU plus Country specific over and underweights of currencies.

This provides the investor with access to the liquidity of a standardized WPU contract.

This means lower trading costs and supports the growth in the country’s domestic financial markets.

I believe the US Dollar is going to go up, why should I hedge into WPU?

Financial risks can be managed by forecasting returns or by diversification. Forecasting currency returns successfully is very difficult: There is no theoretical or empirical evidence that currency returns can be forecast consistently. The US Dollar may go up. But that is not likely to continue forever. Hedging into WPU leads to outcomes which are less extreme, and holding a diversified portfolio is less prone to second guessing at the worst possible time.

Will WPU undermine the role of the US Dollar?

No. WPU is not a new currency. WPU has low volatility. Hence, it enables global investors to be less reactive to large moves in one single currency. So using WPU makes it far safer for an investor to invest more assets overseas. This helps to reduce the investor’s “home country bias”. Globalization leads to more investment into the US, because the US has the world’s largest capital markets.

Can I hedge large exposures into WPU?

Yes. WPU was constructed to be highly liquid. The eleven currencies in WPU account for 88% of all global currency trading. To ensure that the basket is highly liquid, there is lower weight in the less liquid currencies. An institution can hedge US $1 Billion into WPU with little market impact. We were asked by one institution to analyze how long it would take to hedge $20 bn into WPU. In normal market conditions, $20bn could be traded in WPU in two days with little, or no, market impact.

Developing countries have less liquid local currencies. It is difficult for them to hedge foreign currency risk. For this reason, large investors often keep too high a proportion of their assets in local markets. Hedging foreign assets into WPU enables them to invest more internationally. Holding the foreign currencies in the WPU basket also acts as a “tail hedge”. This protects their wealth if their home currency falls due to a major domestic event, such as an earthquake, conflict or local political or financial crisis.

Disclaimer

The FTSE WPU Index Series is calculated by FTSE International Limited (“FTSE”) or its agent. All rights in the FTSE WPU Index Series vest in FTSE. “FTSE®” is trade mark of the London Stock Exchange Plc (LSEG) and The Financial Times Limited and is used by FTSE under licence. “WPU®” and “World Parity Unit®” are registered trade marks of Mountain Pacific (“Mountain Pacific”). Neither FTSE nor their licensors nor Mountain Pacific shall be liable (including in negligence) for any loss arising out of use of the FTSE WPU Index Series by any person.

[1] Based on volume data in the BIS Triennial survey for April 2019.

[2] Source: Federal Reserve Bank of St Louis, https://research.stlouisfed.org/fred2/series/TWEXB April 30, 2014.

[3] The EM weights are subject to no weight being more than 1.5 times the average. This limits the Renminbi exposure, because the offshore Renminbi liquidity is poor.

[4] Note that, in contrast, the SDR weights are fixed. Hence, the SDR cannot be held passively: a portfolio to track the SDR must be continually traded to bring the weights back in line with the fixed SDR weights as exchange rates move.

[5] There is very large borrowing of US Dollars by non US companies. The rise in the Dollar creates acute pressure on their finances.

[6] “The Foreign Exchange Market: A Random Walk with a Dragging Anchor”, Economica, 55, 1988. Professor Charles Goodhart of the LSE worked at the Bank of England for seventeen years.

[7] Note that currencies are nominal, fiat, instruments. It is not possible to hedge real value with nominal instruments. However, as the EM countries are the marginal price setters for global goods, the inclusion of EM currencies provides some protection of long run global purchasing power.

[8] Based on the MSCI All Country equity index as of July 19, 2023.

[9] Based on WPU weights as of July 17, 2023.

[10] http://www.imf.org/external/np/tre/sdr/sdrbasket.htm.

[11] USDX is a Registered Trademark of ICE Futures U.S., Inc., registered in Japan and the United States.

[12] The USDX® weights were derived from an out-of-date Federal Reserve trade weighted currency index. Hence, it has a very high 57.6% weight, in Euros. This index was designed to measure US trade competitiveness.